Your equipment costs you money. All those repair bills and routine maintenance can add up! You can track those expenses - and any revenue that it brings in as well - with the Accounting features under the Equipment section of your Farmbrite account. Navigate to Resources in the main menu, and then select Equipment. Pick the piece of equipment you'd like to work with with, and then choose Accounting .

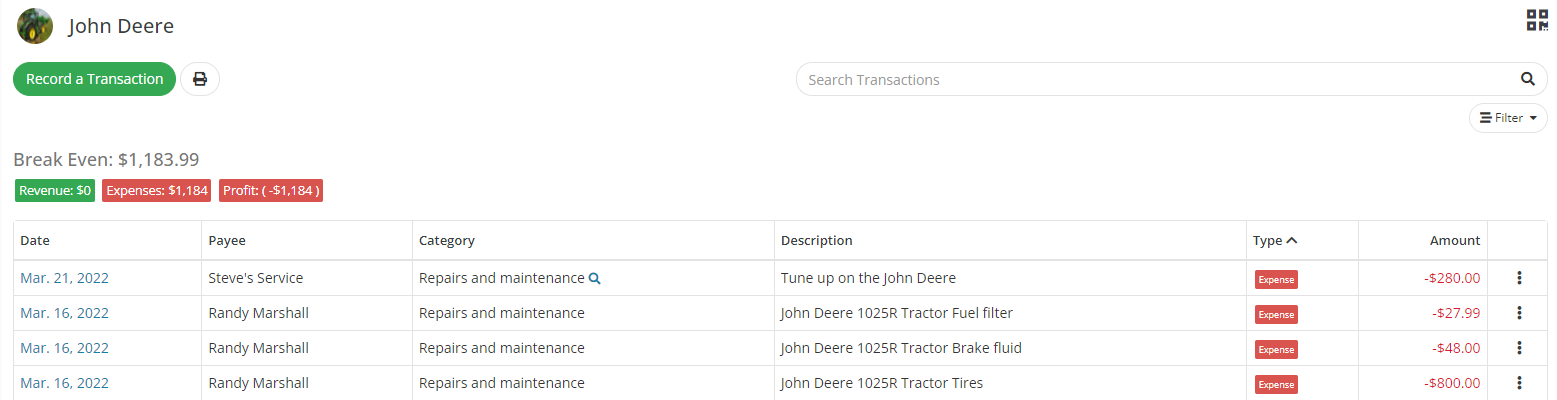

You'll record transactions associated with this piece of equipment to report revenue and expenses, which then total to a profit or loss. Existing transactions will be shown on the Equipment Accounting homepage, with a total calculated profit and break even amount at the top.

Whether you're adding an expense or revenue transaction, you'll click the button to Record a Transaction. Add information to the fields relevant for you on this transaction, and click Save. Alternatively, click Save and New to add another transaction immediately.

Let's break this down into a practical example. In the 2nd screenshot that you see above we are showing the difference between the transactions recorded through the accounting tab and the transactions already associated with the tractor that were created in the accounting tab through that Vehicle (which you may have noticed in the 1st screenshot.)

In our example, we created a single "Repairs and Maintenance" accounting entry for $280 and used the description "Tune up". This summarizes the total tune up into a single transaction. This shows the total of all parts and labor that we paid to Steve's Services as well as the check number.

However, we also do some of the maintenance ourselves - just buying the parts and then working on the tractor in our spare time. We recorded maintenance records for these, and used the feature to "Record Service in Accounting Section as a Repair Expense". This automatically takes the cost and the part/service selected and creates an accounting transaction for it.

You can see the image below; the March 16th transaction entries were added via the Maintenance records and the March 21st entry was added through Accounting expenses.

Both methods calculate into the profit and loss the same way; it's up to you which you find easier!