If you've been in business for a while, you'll likely think of your current sales and expenses as building on previous fiscal years. Like your harvests and livestock, some of those years may have been more fruitful, and others might have been more lean. You'll keep building on that foundation you've started with with this roll over amount carried forward; it might help you to see what you've accumulated over that time, or what you need to build back from.

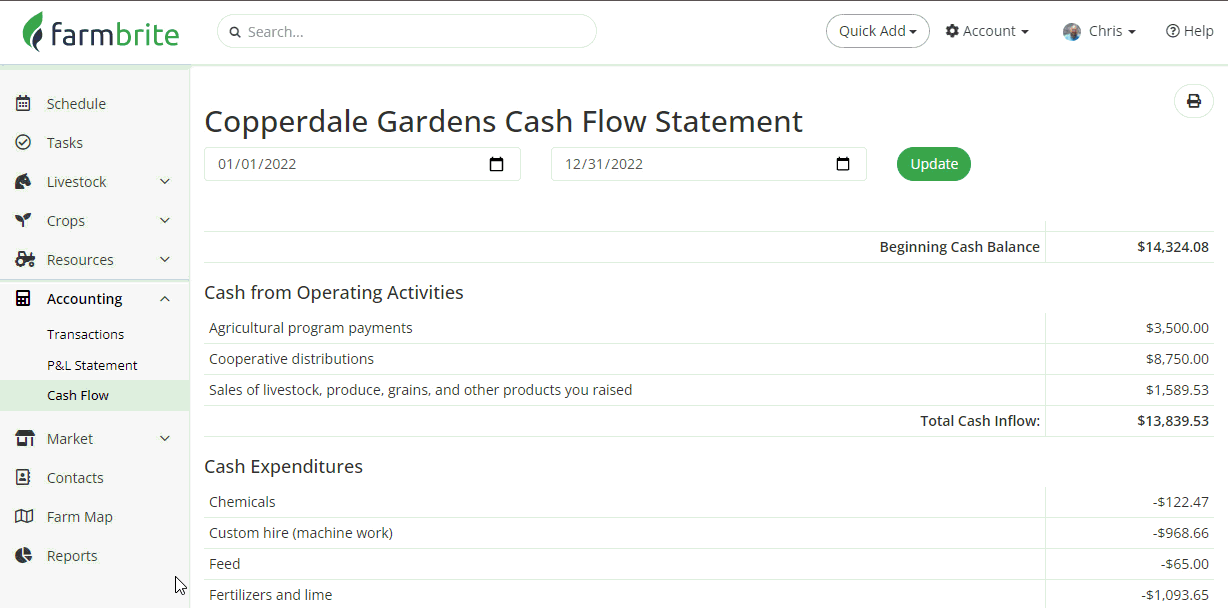

If you'd like to see a running total for you business finances that includes a previous period starting balance, you'll find the Cash Flow Report very useful. Like the Profit and Loss Statement, the Cash Flow Report will show you income and expenses during a given period to calculate a total. Beyond that, the main highlight is that it will use all transactions prior to your start date to calculate a Beginning Cash Balance. This gives you a running total for your business operations.

In our example below, we are starting with an beginning cash balance of $14,324.08, which was the total profit we saw from transactions prior to 1/1/2022. We'll roll that cash into our 2022 fiscal year, and see that after income and expenses we now have $23,312.62 as an ending cash balance. If you're new to Farmbrite, you can add your beginning cash balance as a single transaction to still get the benefit of this report.

Entering a line of credit

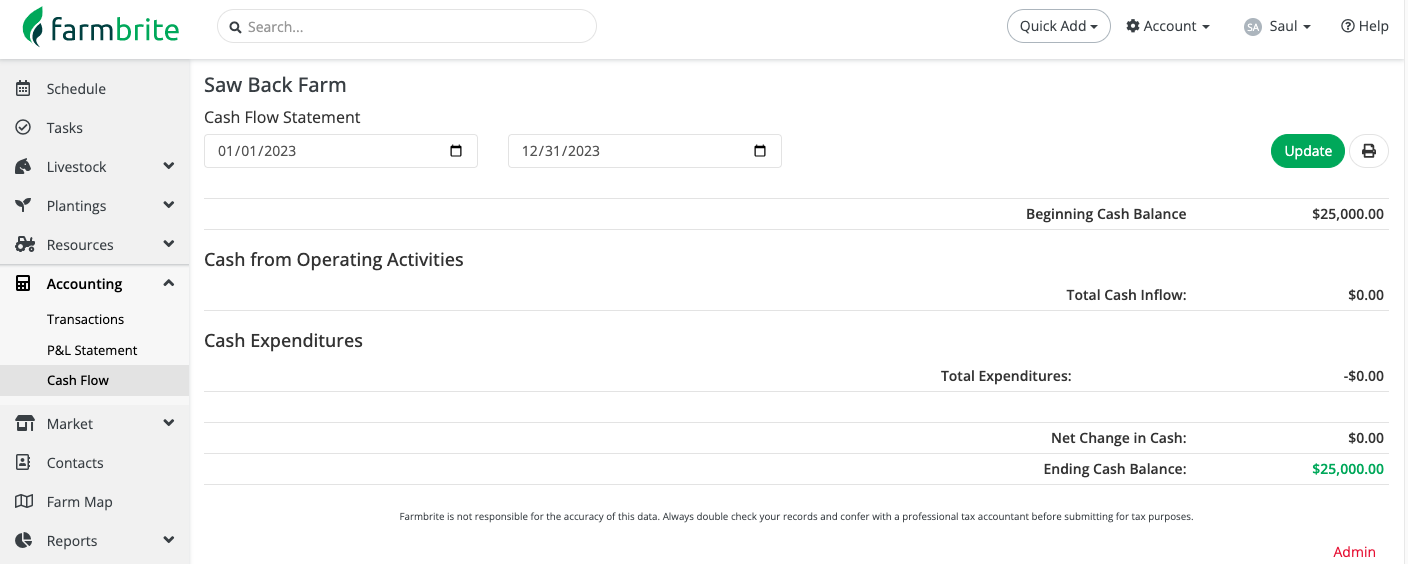

You can also use this area to enter a loan or line of credit. You can add an income transaction and have the balance come forward for that year. For instance, in this example we've added a line of credit for the year before so that the balance will roll over to the next year.

Then when you go to look at your cash flow report, that money from the line of credit has rolled over to a balance for this year.

Just as a note, the category items in the expenses and income section come directly from the IRS Schedule F by default, but you can customize a chart of accounts top create your own categories.

Have any questions about this report? Let us know, we are glad to help!

Farmbrite recommends that you work with an accounting professional for any questions specific to your business accounting. They can help ensure compliance with your local laws and offer advice on how to best account for your business needs.